Social Security Tax Limit 2025 Withholding Meaning. You aren’t required to pay the social security tax on any income beyond the social security wage base limit. Oasdi tax, also known as social security tax, is collected from paychecks to fund the social security program.

The maximum benefit depends on the age you retire. Maximum taxable earnings ( en español) if you are working, there is a limit on the amount of your.

Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf.

What Is The Social Security Tax Rate For 2025 Madge Rosella, We call this annual limit the contribution and benefit base. For 2025, the social security tax limit is $168,600.

What Are The Tax Withholding Rates For 2025 Dniren Shayne, If too much money is. [3] there is an additional 0.9% surtax on top of the.

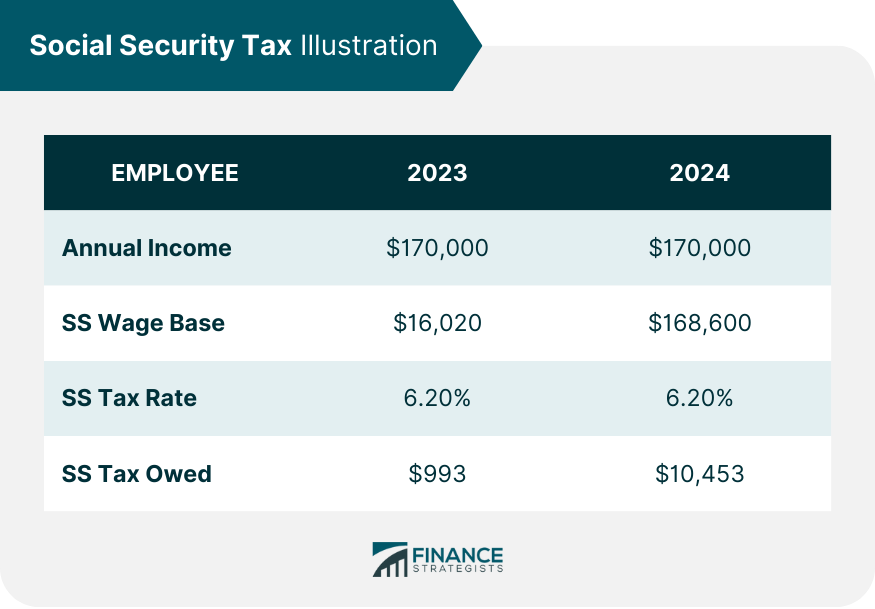

How To Calculate, Find Social Security Tax Withholding Social, The 2025 social security wage base is $168,600, up from the 2025 limit of $160,200. If too much money is.

2025 Social Security Withholding Limit Cammy Caressa, The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 is $10,453.20 ($168,600 x 6.2%). In 2025, that number is $168,600.

Social Security Tax Amount 2025 Elie Janenna, This amount is also commonly referred to as the taxable maximum. Earn less and you’re taxed.

Social Security Tax Limit 2025 Here Are The Pros And Cons, In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. For 2025, your wages up to $168,600 are taxed at 6.2% for social security, and your wages with no limit are taxed at 1.45% for medicare.

Social Security Taxable Limit, The social security wage base limit is $168,600.the medicare tax rate is. 11 rows benefits planner | social security tax limits on your earnings | ssa.

Social Security Tax Definition, How It Works, and Tax Limits, In 2025, the oasdi tax rate is 6.2% for employees. Maximum taxable earnings ( en español) if you are working, there is a limit on the amount of your.

Maximum Social Security Benefit 2025 Calculation, For example, if you retire at full retirement age in 2025, your maximum benefit would be $3,822. Keep an eye on the oasdi limit—it’s your earnings ceiling for social security taxes.

Social Security And Medicare Tax Rate 2025 For Self Employed Rycca, If too much money is. In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600.

DIY Tutorials WordPress Theme By WP Elemento