How Much Mortgage Interest Is Tax Deductible 2025. The mortgage interest deduction allows you to reduce your taxable income by the amount of money you've paid in mortgage interest during the year. If you are married and filing jointly or file as a qualifying widow (er), your 2025.

What types of loans qualify for the mortgage interest deduction? If you are married and filing jointly or file as a qualifying widow (er), your 2025.

Understanding the Mortgage Interest Deduction The Official Blog of, You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. This means you'll pay $1,760 less in taxes that year.

Understanding the Mortgage Interest Deduction With TaxSlayer, Current irs rules allow many homeowners to deduct up to the first $750,000 of their home mortgage interest costs from their taxes. If you’re married filing separately, that limit drops to $375,000.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage, Mortgage interest is generally deductible, yes. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness.

Investment Expenses What's Tax Deductible? (2025), Mortgage interest tax deduction calculator to calculate how much tax you can deduct from your monthly. Married taxpayers filing separately can deduct up to $375,000 each.

When Is Mortgage Interest Tax Deductible?, Getting a tax refund is a sweet perk of filing your income tax return—and the good news is that most canadians get one. Changes to tax relief rules mean some landlords face higher bills.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, If you are married and filing jointly or file as a qualifying widow (er), your 2025. Follow the three steps mentioned below to claim a home mortgage interest deduction in 2025:

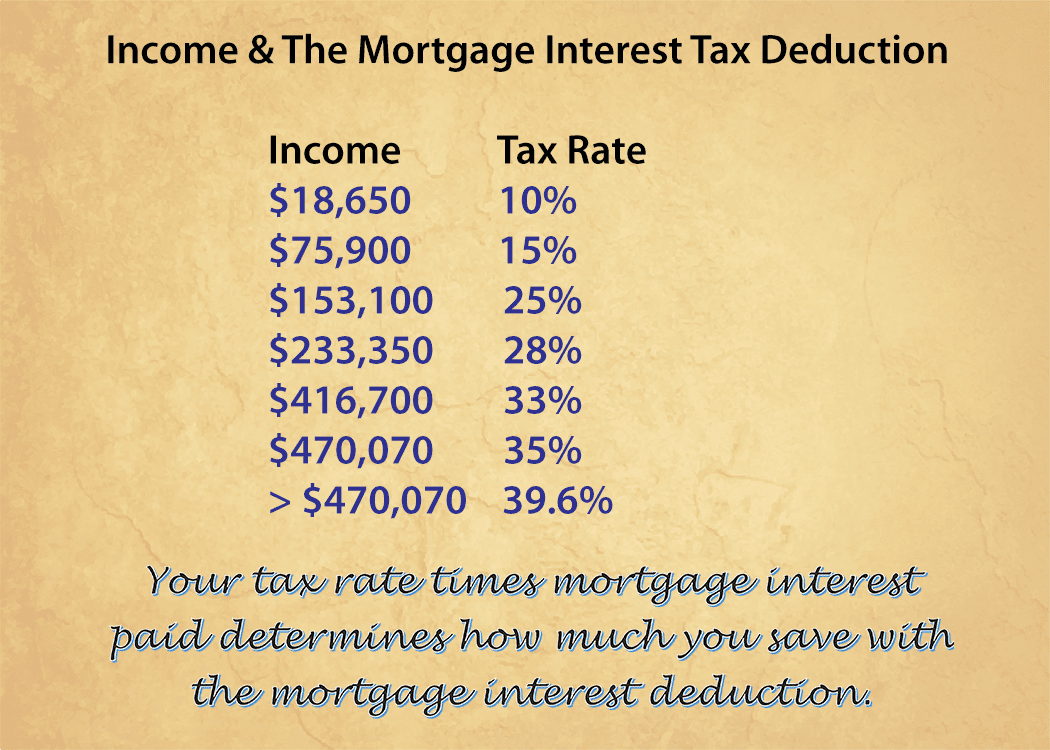

How To Estimate Mortgage Interest Deduction In 2025?, If you're in the 22% tax bracket, you can deduct $1,760 from your taxable income ($8,000 x 0.22 = $1,760). But you should be aware of the limits if you're planning to deduct the interest you paid on your mortgage when you.

How Does Deductible Mortgage Interest Work For Taxes? YouTube, You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. If you’re married filing separately, that limit drops to $375,000.

How to make your mortgage interest tax deductible YouTube, Current irs rules allow many homeowners to deduct up to the first $750,000 of their home mortgage interest costs from their taxes. The deduction is only available for interest paid on the first $750,000 of your mortgage debt.

3 Things You Need to Know About Your Mortgage's Interest Rate Real, The second policy scenario is president biden’s budget for fiscal year 2025, which proposes more than $3.4 trillion in net tax increases that will reduce investment. For the 2025 tax year, married couples filing jointly, single filers and heads of households can deduct up to $750,000.